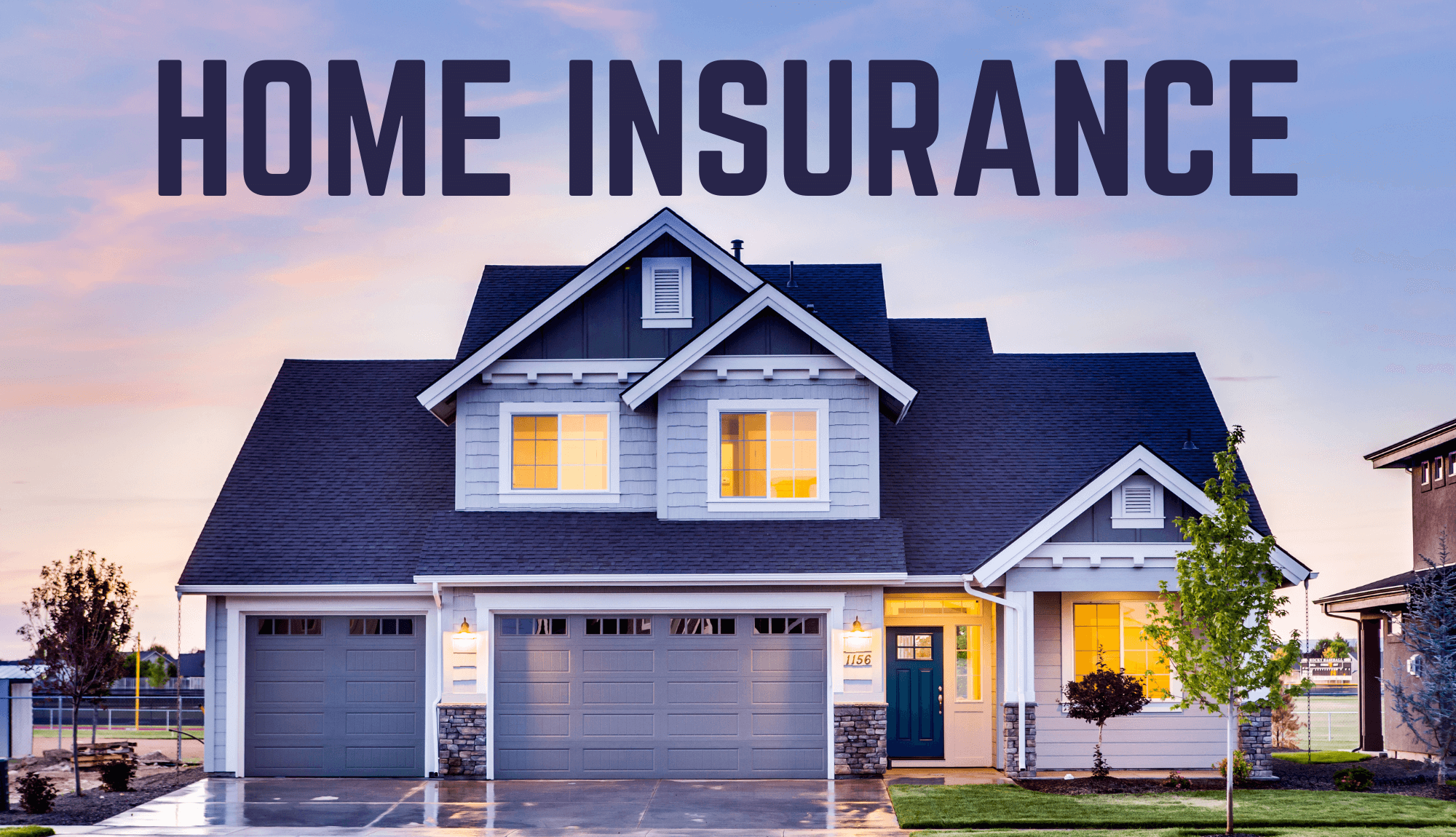

Dallas and Fort Worth Home Insurance

Why do I need Homeowners Insurance?

Homeowners Insurance provides coverage for the individual’s house and personal assets. It also protects you from liability suits if someone has been injured on your property due to negligence.

Homeowner – Condo and Rental Insurance

Condo Insurance

We have great rates for condo and coop insurance. Give us a call to get rates and save over $500.

Apartment Insurance

Bundle your home insurance plan to fit your needs. We can save you money if you combine your health, life and auto insurance.

Home and Auto Bundle

Save up to 25% when you bundle home and auto insurance policies. You can save if you bundle your car with home or renters policy.

Business Insurance

We provide high-quality, competitive insurance, financial, and risk management education for behavioral health professionals.

Motorcycle Insurance

Our motorcycle insurance policy protects you and your motorcycle, whether you’re enjoying a long summertime ride or have your bike stored away for the winter.

Renter Insurance

Compare our renters insurance policy rates and get affordable quote today. Renters Insurance covers theft and injuries that you are liable for to visitors.

Understanding Homeowners Insurance

Homeowners must provide proof of insurance on their properties before they can be given a mortgage. The type and level will depend upon the specific lending bank.

Homeowners can compare multiple offers and choose the right plan that fits their needs. If they don’t have a homeowner’s policy, banks may be able to offer one at an extra cost or liability.

With a homeowner’s insurance policy, you can rest assured that your monthly payment will go towards paying for the cost of coverage. This means if there is an accident or claim, it will be covered by the company. All transactions related to these events happen smoothly without worry.

House Insurance

What Does A Home Insurance Cover?

Homeowners insurance is a great way to protect your assets from unforeseen events. It covers four different types of incidents that could happen on the insured property – interior damage, exterior destruction or loss/damaged belongings, and injury occurring inside buildings and outside if you’re present at home with no fault.

KEY TAKEAWAYS

Homeowner’s insurance is a form of property insurance that covers losses and damages to an individual’s house and to assets in the home. The policy usually covers interior damage, exterior damage, loss or damage of personal assets, and injury that arises while on the property.

Every homeowner’s insurance policy has a liability limit, which determines the amount of coverage that the insured has should an unfortunate incident occur. Acts of war or acts of God are typically excluded from standard homeowners insurance policies. Homeowner’s insurance policy is different from a home warranty and mortgage insurance.

Does It Make Sense To Include Your Auto Insurance Policy With Your Home Insurance Policy?

If you want to save money on your insurance, the bank can add coverage for both home and auto products together in one package or policy renewal period. The company would offer their customers even better deals than they otherwise could have offered individually.

There are many advantages of dealing within a single brand rather than two separate brands from different providers.

Some insurance companies indeed specialize in one type of coverage, but if you’re looking for the best company to meet your needs, then consider checking out Geico and Lemonade.

Is It Better To Get A Low Deductible Or High Deductible?

To protect yourself from high insurance premiums, you must have a low deductible. The lower the amount paid in advance by an individual or company before their policy kicks into gear and covers everything else up until its limits, the more money they will spend on your claim.

Texas Insurance for Homeowners

What Is Homeowners Insurance?

Homeowners Insurance provides coverage for the individual’s house and personal assets. It also protects you from liability suits if someone has been injured on your property due to negligence.

Understanding Homeowners Insurance

Homeowners provide proof of insurance on their properties before they can be given a mortgage. The type and level will depend upon the specific lending bank.

Homeowners can compare multiple offers and choose the right plan that fits their needs. If they don’t have a homeowner’s policy, banks may be able to offer one at an extra cost or liability.

With a homeowner’s insurance policy, you can rest assured that your monthly payment will go towards paying for the cost of coverage. This means if there is an accident or claim, it will be covered by the company. All transactions related to these events happen smoothly without worry.

Key Takeaways

This type of insurance covers the losses and damage to the property and assets of the insurance holder. If interior or exterior damage, personal assets loss, or injury to the individual while on the property occurs, the bank will provide full coverage through this insurance.

Homeowner’s insurance differs from a home warranty and mortgage insurance. It may need an increase in value due to certain disasters beyond just theft or damage caused intentionally by another person. It’s important to know your limit on liability, which will be determined by the type of policy you have coverage for and any other add-ons like flood or Wildfire protection.

What Does A Homeowner’s Insurance Cover?

Homeowners insurance is a great way to protect your assets from unforeseen events. It covers four different types of incidents that could happen on the insured property – interior damage, exterior destruction or loss/damaged belongings, and injury occurring inside buildings and outside if you’re present at home with no fault.

Does It Make Sense To Include Your Auto Insurance Policy With Your Home Insurance Policy?

If you want to save money on your insurance, the bank can add coverage for both home and auto products together in one package or policy renewal period. The company would offer their customers even better deals than they otherwise could have offered individually.

There are many advantages of dealing within a single brand rather than two separate brands from different providers.

Some insurance companies indeed specialize in one type of coverage, but if you’re looking for the best company to meet your needs, then consider checking out Geico and Lemonade.

Is It Better To Get A Low Deductible Or High Deductible?

To protect yourself from high insurance premiums, you must have a low deductible. The lower the amount paid in advance by an individual or company before their policy kicks into gear and covers everything else up until its limits, the more money they will spend on your claim.